What is Outsourced Accounting and How Could It Help You? Bench Accounting

It also syncs with either QuickBooks Online or Netsuite (as opposed to syncing just with QuickBooks, like most virtual bookkeepers). With outsourced accounting services, you’ll have meticulous eyes that can process financial data while ruling out fraud simultaneously. Today, the average salary for a bookkeeper in the U.S. is $45,160, the average controller earns $104,338, and the median CFO salary is $393,377. By comparison, outsourced accounting services typically cost a fraction of these rates and deliver better results.

Accounting Outsourcing: How to Hand off Your Financial Tasks (With Recommendations)

- At the same time, bookkeeping is a relatively manual, labor-intensive process that takes up a significant amount of time.

- Once you’ve signed an agreement, your service provider will need access to your data.

- And they generally cost less than hiring expert bookkeepers and accountants.

This ensures you’re getting the best support and advice on a range of financial matters, from tax planning to financial forecasting and budgeting. As your company grows, you may find it harder to keep up with all your accounting responsibilities, such as payroll, tax filing, and reconciling your accounts. To discuss outsourcing your finance and accounting, as well as our customizable solutions, request a demo today. Once the trial project is done and analyzed, you should have a clear picture of how well an outsourcing provider fits your financial and accounting needs. Access to tax and wealth advisors can assist in building an efficient financial roadmap for your business. They can help you with individual tax planning, business continuity, disaster recovery and risk management, risk mitigation, and other aspects of financial planning.

The 8 Best Virtual and Outsourced Accounting Services for Small Businesses in 2023

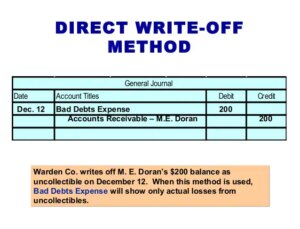

If errors in your books keep appearing, that means the person taking care of your books is not doing the right job. By outsourcing these services, you can take advantage of the multiple layers of the direct and the indirect method for the statement of cash flows review built into your provider’s processes, which allows them to detect most errors on time. And even if any error creeps up, you won’t be the one that has to deal with it. If you are using paper-based accounting information, you should switch to document management programs or accounting software that can categorize everything for you.

Outsource your payroll management with Remote

If you’re aiming to raise additional funding or are targeting a potential exit, well-organized financial record-keeping will significantly streamline the due diligence process. Would you rather tackle accounting yourself instead of outsourcing it to a third party? Check out our list of the year’s best accounting software for small businesses to get started.

You’ll want to set clear expectations from the start about the scope of work, not to mention how to handle any tasks balance sheet template outside of that scope, especially if you’re paying hourly. An early and open discussion about this can keep you from being hit with unexpected costs down the line. Once you’ve set your sights on outsourcing, the road to choosing a provider might get a little bumpy.

From humble beginnings, the global outsourcing market has grown at a rapid rate as governments realize the economic benefits of providing services for other nations. This is particularly so in the accounting and bookkeeping sector, with several countries particularly invested in nurturing such talent. These figures should serve as a rough guideline to estimate the range of your budget for outsourced finance services. Playing the role of accountant probably wasn’t part of your business plan. As the owner, you want to grow your business and focus on the vision of the company itself.

Your company can gain game-changing financial insights and unlock benefits including increased cash flow and higher profit margins. If that sounds like something you’d be interested in, read on to learn all about outsourced accounting. You can also mitigate this concern by assessing the security measures of your potential provider. For example, Remote’s payroll services are protected by the latest ISO-standard security protections, with a 24/7 on-call security team. These kinds of steps can give you peace of mind and help ensure you avoid any costly slip-ups. If you think you can are we seeing the demise of stress testing get by without any accounting function, you’re in for a whirlwind of a surprise (and not in a good way).

Financial planning and accounting are two critical components of running a successful business. This article will guide you through the concept of outsourced finance and accounting services, discuss the latest trends, and help you understand how to outsource these services. That means you won’t get to spend as much face-to-face time with your accountant as you would if they were your employee. If you’re bringing in an outsourced controller to help manage your existing team, it’s necessary to carefully consider what this relationship will look like. If you’re the type of person who likes to shake someone’s hand and look them in the eye, the remote nature of outsourced accounting may require some adjustment. Because accounting can be so complex, it’s often pushed to the back burner.